23+ Profit Sharing Calculator

The actual rate of return is largely dependent on the types of investments. But heres one method to considercalculate the.

Solo 401k Contribution Calculator Solo 401k

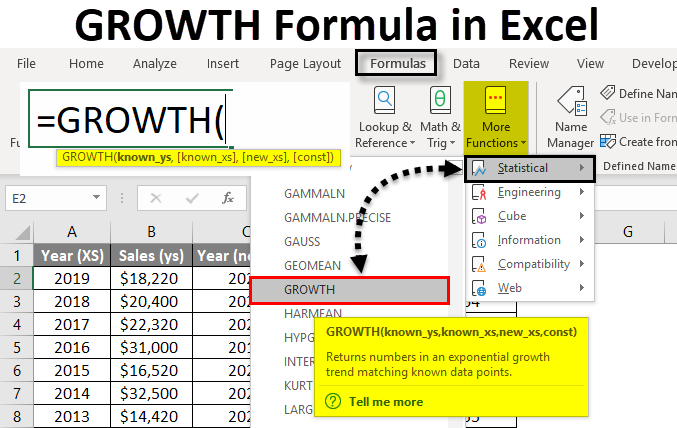

Web How Do You Calculate Profit Sharing.

. A profit-sharing plan can help a business attract employees and motivate them to perform. Published on 25 Oct 2018. Web This calculator will help you figure out how much of your salary you might want to set aside how fast that money can grow based on certain rates of return and the benefits provided.

There are certain situations where you can shift large amounts of tax-deferred dollars to the business owner and key employees. This free calculator will help you determine how much income you can. Web This calculator will help you figure out how much of your salary you might want to set aside how fast that money is likely to grow at certain rates of return and the benefits provided.

Developing the right formula for your business takes some trial and error. Web This calculator assumes that your return is compounded annually and your deposits are made monthly. Web If you have more than one defined contribution plan you must calculate and satisfy your RMDs separately for each plan and withdraw that amount from that plan.

Web A profit-sharing plan is a great way to ensure you have plenty of money saved up for your golden years. Web Simplify the process of calculating contributions and determining employee eligibility in your business retirement plan with the Small Business Retirement Contribution Calculator. By using legal plan.

An Individual 401 k plan a SEP IRA a. Web How to Calculate Profit Sharing. Web Profit Sharing Calculator Odyssey Advisors Profit Sharing Calculator Complete the form and well email you a free profit sharing calculator for up to 25 employees which.

Web Use the self-employed 401k calculator to estimate the potential contribution that can be made to an individual 401k compared to profit-sharing SIMPLE or SEP plans for 2008. Web Self-employed individuals and businesses employing only the owner partners and spouses have several options for tax-advantaged savings. Web Supercharge your 401-K.

Web It may surprise you how significant your retirement accumulation may become simply by saving a small percentage of your salary each month in your 401 k plan.

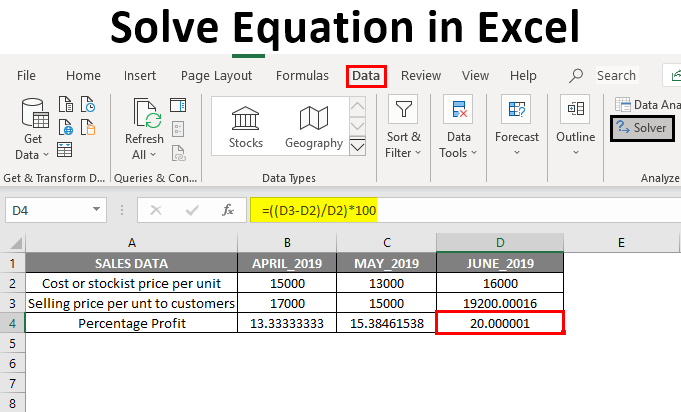

Solve Equation In Excel How To Solve Equation With Solver Add In Tool

Profit Sharing Calculator Youtube

Partnership Profit Sharing Calculator In Excel Youtube

What Is The Area Of A Triangle The Sides Of The Triangle Are 91 Cm 98 Cm And 105 Cm Quora

Profit Sharing Percentage Type Benefits Types Of Profit Sharing Plans

Free 7 Sample Monthly Expense Calculators In Pdf Excel

Here S What Happened When I Introduced Profit Sharing The New York Times

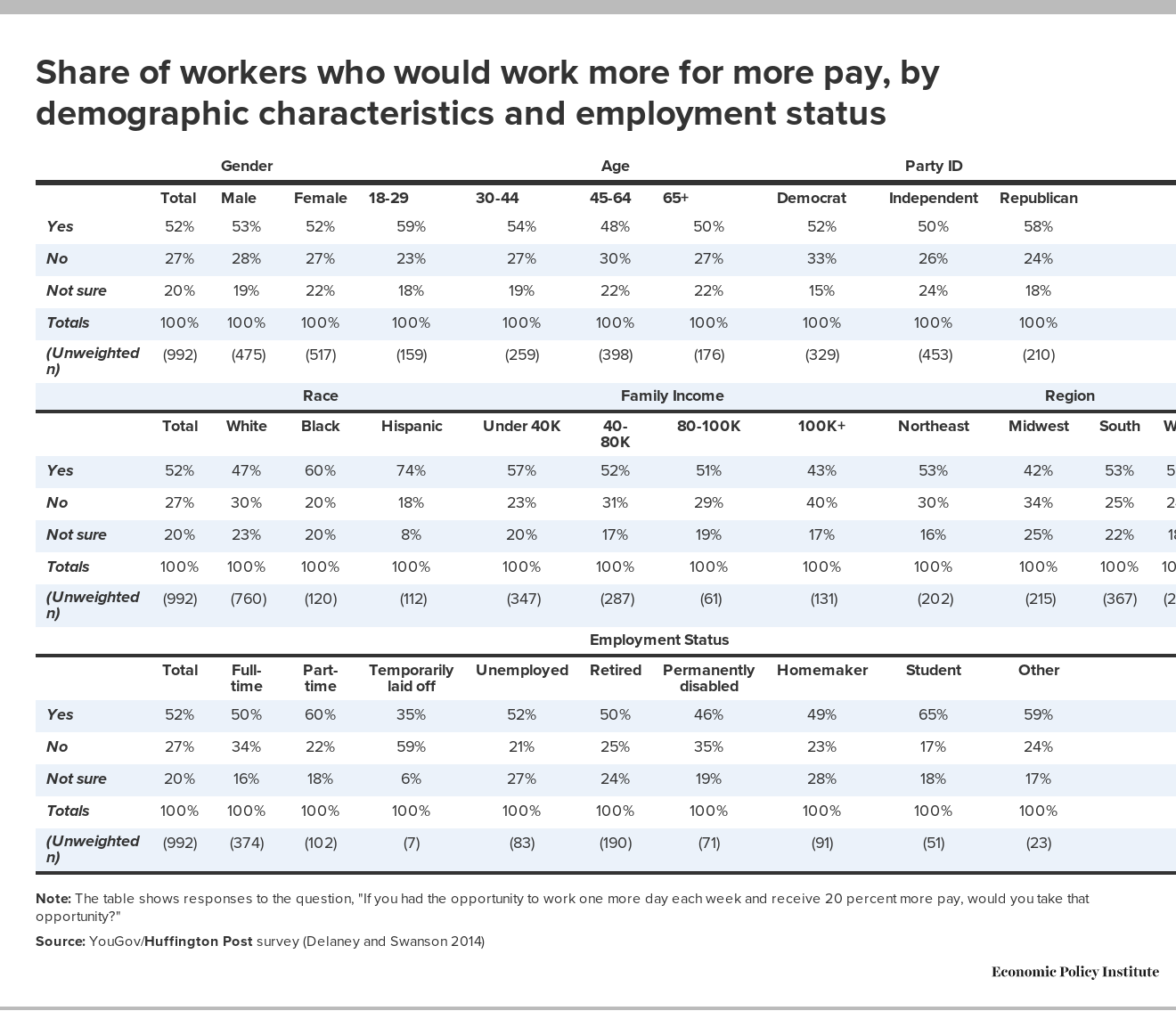

Irregular Work Scheduling And Its Consequences Economic Policy Institute

How To Calculate Profit 12 Steps With Pictures Wikihow

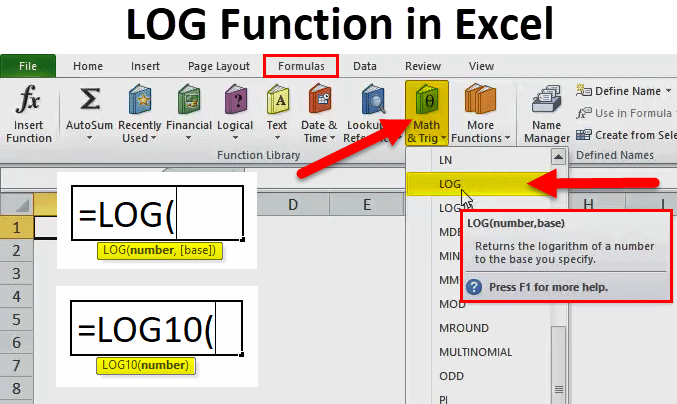

Log In Excel Formula Examples How To Use Log Function

Important Employment Law And Payroll Changes In 2022 Price Bailey Chartered Accountants

Rd Sharma Solutions For Class 7 Maths Chapter 23 Data Handling Ii Central Values Avail Free Pdf

If Sin 8 5 13 Then How Do You Determine Sin 8 2 Without A Calculator Quora

What Is The Formula To Find Out Next Multiple Of 5 Of A Number I E Ceiling Round Off In Excel Quora

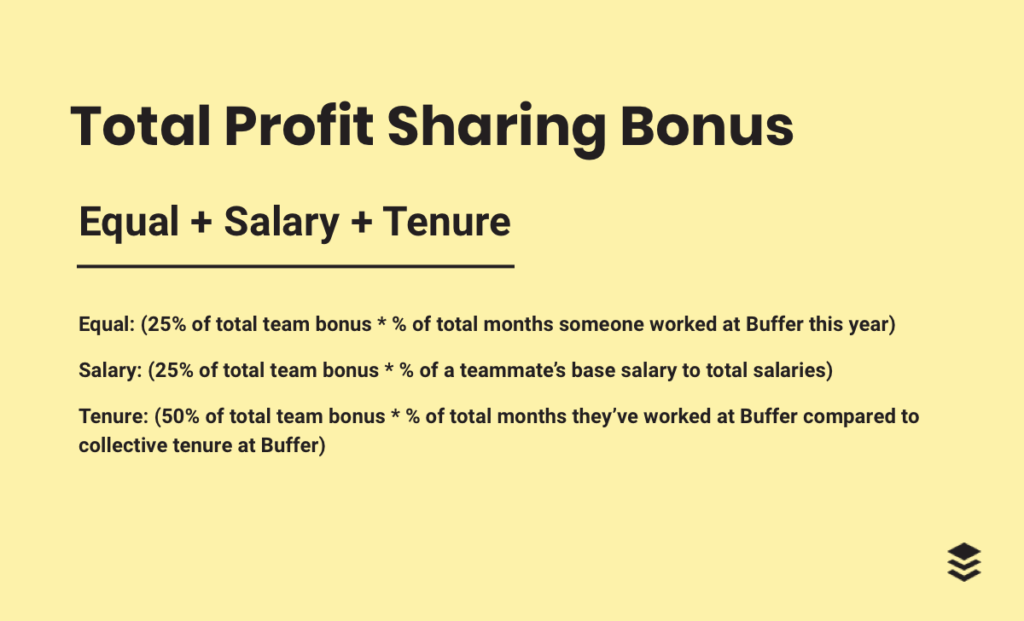

We Gave 473 996 To Teammates And Non Profits Here S Our Profit Sharing And Charitable Contributions Formula

Profit Sharing Calculator Calculator Academy

What Is Net Profit And How To Calculate It Glew