22+ income ratio mortgage

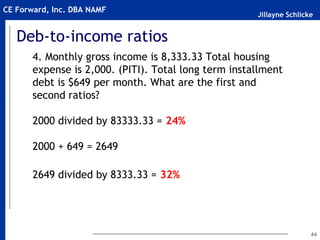

Web The 28 rule says that you shouldnt pay more than 28 of your monthly gross income on mortgage paymentsincluding taxes and homeowners insurance. 1800 5000 is 36 of your income so your debt-to-income ratio is 36.

Average Mortgage To Income Ratio For Different Income Quintiles Download Scientific Diagram

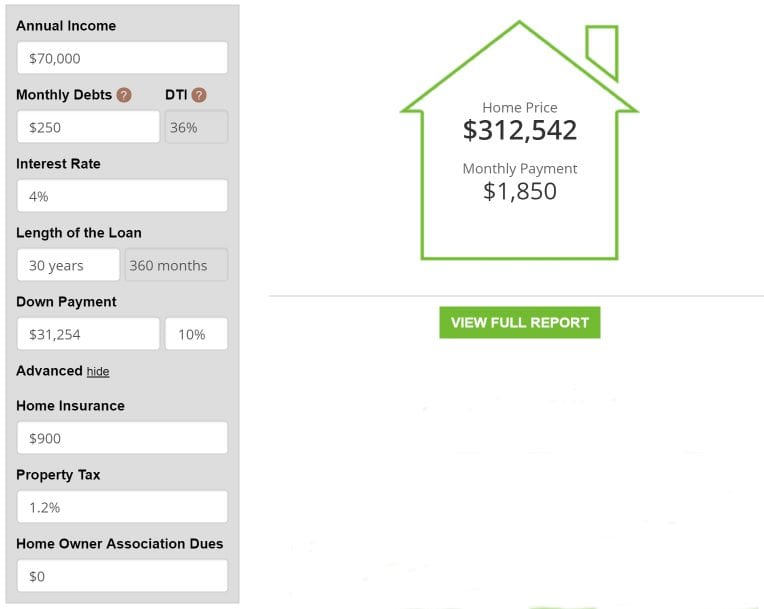

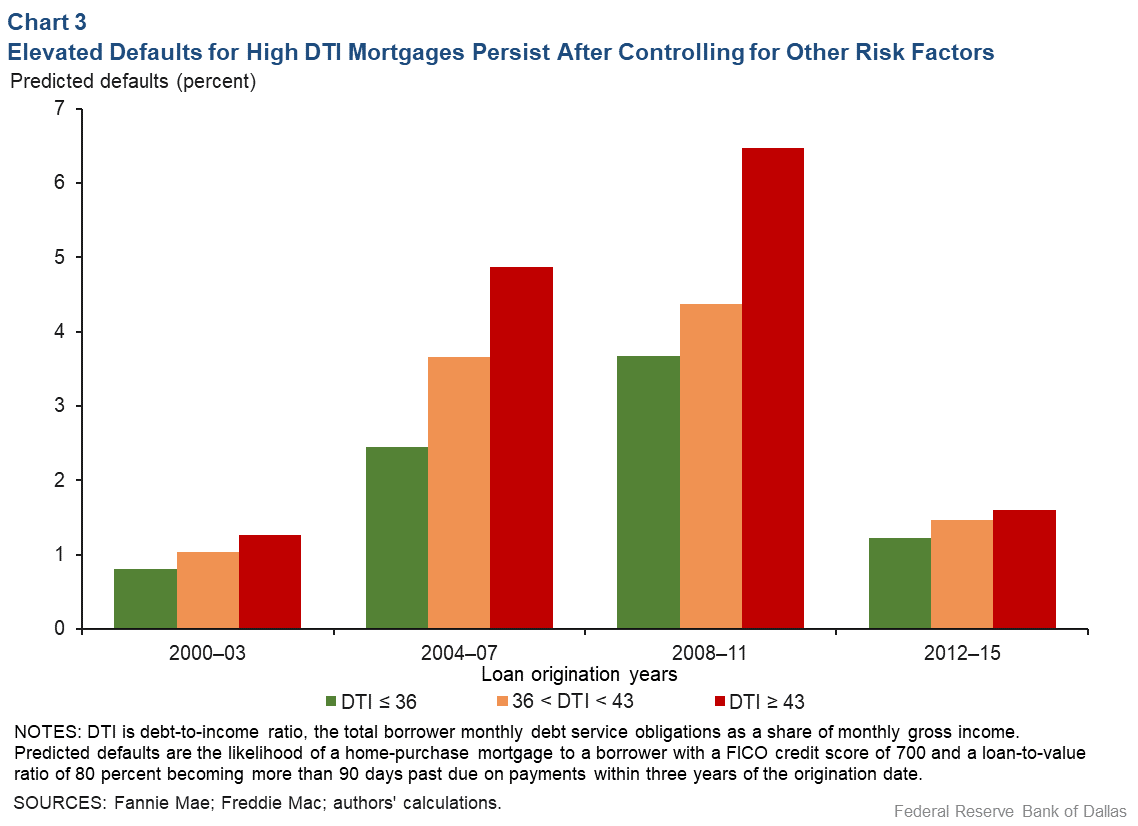

Generally speaking lenders require a DTI of 43 or less depending on your credit score to.

. For example if you make 10000 every month multiply 10000 by 028 to get. Web The 28 front-end ratio You may hear your lender use the term front-end ratio This is the ratio of your monthly housing expenses versus your monthly gross income and according to the. You can calculate your DTI by adding up your monthly minimum debt payments and dividing it by your monthly pretax income.

You have a total of 2000 of recurring debt obligations which include a car. Web This ratio says that your monthly mortgage costs which includes property taxes and homeowners insurance should be no more than 36 of your gross monthly income and your total monthly debt including your anticipated monthly mortgage payment and other debts such as car or student loan payments should be no more than 43 of your pre-tax. Web 19 hours agoFor its home equity loans Spring EQ only offers fixed-rate loans with repayment terms of five 10 15 20 25 or 30 years.

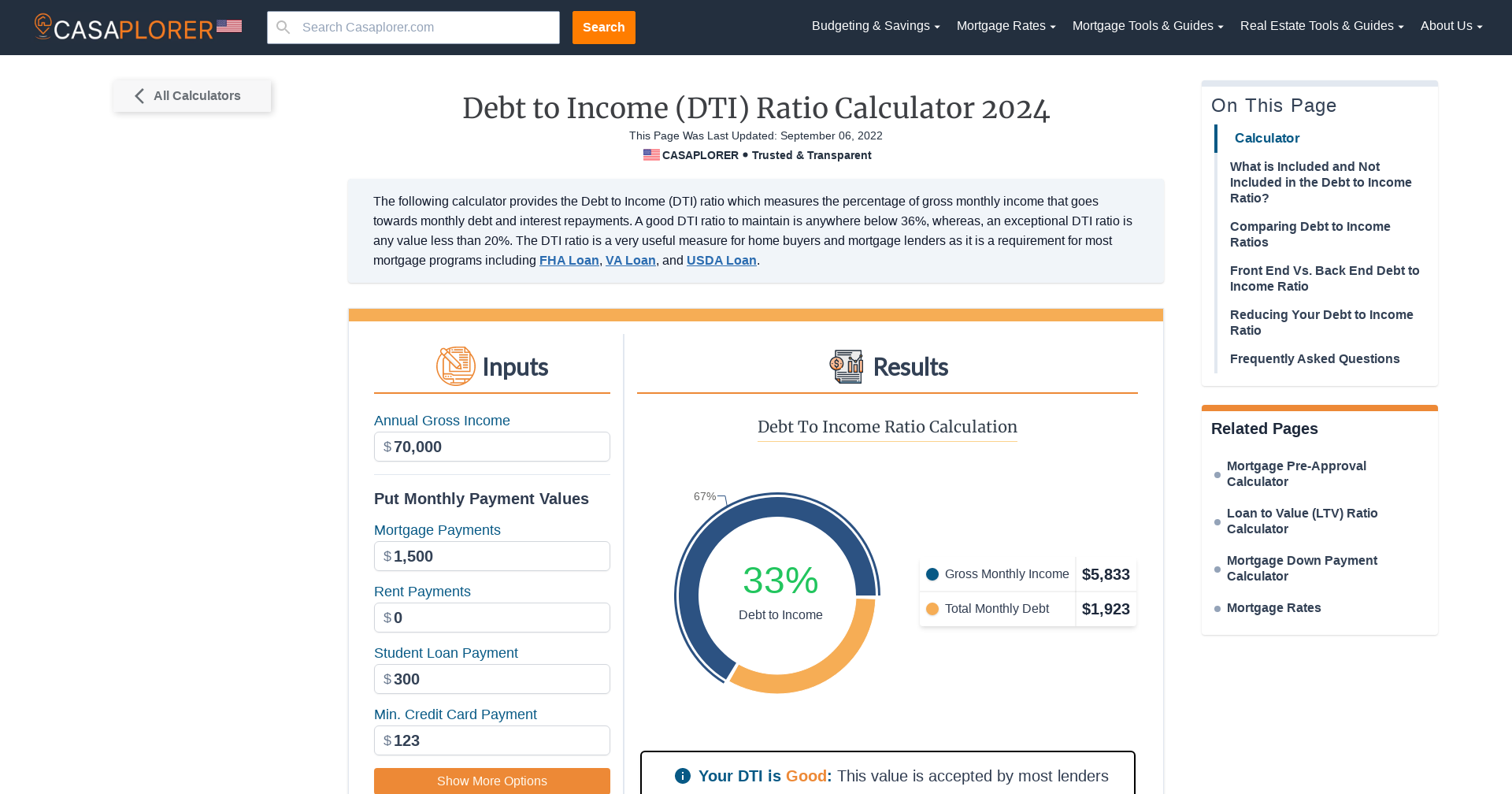

Monthly debt obligations divided by Monthly income times 100 equals DTI. The debt-to-income ratio is one. You pay 1000 toward the principal and interest 150 toward.

Web The QM rules began after the housing crisis to keep lenders more accountable and borrowers choosing smarter loans. This includes cumulative debt payments so think credit card payments car payments student loans. Web 23 hours agoAll new mortgage loan commitments in 4Q-22 and 2022 were floating rate.

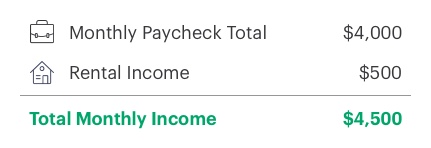

Web Your debt-to-income ratio or DTI is a percentage that tells lenders how much money you spend on monthly debt payments versus how much money you have coming into your household. Web To calculate your front-end ratio add up your monthly housing expenses only divide that by your gross monthly income then multiply the result by 100. Web Zillows debt-to-income calculator takes into account your annual income and monthly debts to determine your debt-to-income ratio DTI -- one of the qualifying factors by lenders to determine your eligibility for a mortgage.

Gross income is what you make before taxes. DTI measures your debts as a percentage of your income. In 4Q-22 the implied dividend pay-out ratio was 73 compared to a higher 90 pay-out ratio in the previous twelve.

Web Based on the 28 percent and 36 percent models heres a budgeting example assuming the borrower has a monthly income of 5000. Your debt-to-income ratio is the amount of monthly recurring debt payments compared to your gross monthly income. This means all of your debts cannot take up more than 43 of your gross monthly income.

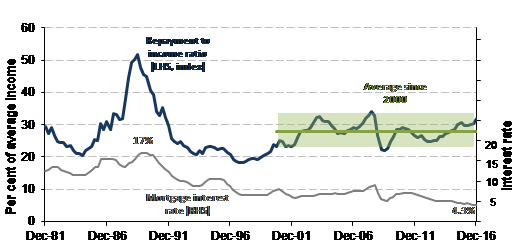

Web 18 hours agoThe income replacement ratio Experts say a general rule of thumb for calculations is 70 per cent the percentage of your current annual income as the amount you should be able to retire on. Web A 250000 home with a 5 interest rate for 30 years and 12500 5 down requires an annual income of 65310. Additionally many mortgage lenders like to see front-end DTI.

Web Debt-To-Income Ratio - DTI. For instance lets say that your gross monthly income is 5000. Its HELOCs operate on a 30-year variable term with an option to only.

Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. To get the back-end ratio add up your other debts along with your housing expenses. Say for instance you pay 350.

It represents the percentage of your monthly gross income that goes to monthly debt payments including your mortgage student loans car payments and minimum credit card payments. Were not including any expenses in estimating the income you need for a 250000 home. Web A good debt-to-income ratio is often between 36 and 43 but lower is usually better when it comes to applying for a mortgage.

Web A debt-to-income ratio of 20 means that 20 of your income is going toward debt payments. Web 22 income ratio mortgage Senin 06 Maret 2023 Edit. According to the Qualified Mortgage Guidelines your total debt ratio cannot exceed 43.

5000 x 028 28 1400 Maximum mortgage payment 5000 x. The 2836 rule is a good benchmark. Web Calculating your debt-to-income ratio.

Ad NerdWallet Can Help. Web What is debt-to-income ratio and why does it matter when you apply for a mortgage. Web Your front-end or household ratio would be 1800 7000 026 or 26.

2 To calculate your maximum monthly debt based on this ratio multiply your gross income by 043 and divide by 12. To determine how much you can afford using this rule multiply your monthly gross income by 28. Web A good debt-to-income ratio for a mortgage is generally no more than 36 and lower is better because it shows lenders you are unlikely to default.

The debt-to-income DTI ratio is a personal finance measure that compares an individuals debt payment to his or her overall income. Web For example say that your total monthly obligations add up to 2000 when taking into account all your minimum payments and your new mortgage -- and say your income is 6000. Web And you have a rent payment of 1200 a car payment of 400 per month along with a minimum credit card payment of 200.

Use our required income calculator above to personalize your unique financial situation. Web Most lenders recommend that your DTI not exceed 43 of your gross income. For instance if all of your.

Web Mortgage lenders use the debt-to-income ratio to evaluate the creditworthiness of borrowers. Your total monthly debts are 1800. Web A good debt-to-income ratio for a mortgage is generally no more than 36 and lower is better because it shows lenders you are unlikely to default.

Youd divide 2000.

Loan Originator Pre Licensing And Exam Prep

Understanding Housing Affordability Openforum Openforum

How Much Mortgage Can I Get For My Salary Martin Co

A Picture More Misleading Than A Thousand Words John Burns Real Estate Consulting

Mortgage Calculator Enter Your Income See Your Home Price Mortgage Rates Mortgage News And Strategy The Mortgage Reports

What Is Debt To Income Ratio Let S Break It Down Mortgage Firsttimehomebuyer Homeowner By Beth Tucker The Mortgage Company Nmls 1159576 Facebook

Canadian Housing Bubble Goes Into Full Mania Mode A Canadian Debt To Personal Income Ratio Near 145 While Us At Peak Of The Housing Bubble Was At 125 Dr Housing Bubble Blog

Mjd4luowjomtxm

Debt To Income Dti Ratio Calculator 2023 Casaplorer

Ability To Repay A Mortgage Assessing The Relationship Between Default Debt To Income Dallasfed Org

![]()

Understanding Debt To Income Ratio For A Mortgage Nerdwallet

1 Guide For Fha Usda Va Cash Out Home Loans Top Rated Local Buildbuyrefi Home Loan Experts 1 Construction Renovation Cash Out Purchase Loan Experts Buildbuyrefi Com

:max_bytes(150000):strip_icc()/getting-your-first-home-insurance-policy-4040509_FINAL-f4d13668216345e6bdc64bbea77b2fa8.png)

What Is The 28 36 Rule Of Thumb For Mortgages

Understanding Debt To Income Ratio For A Mortgage Nerdwallet

Debt To Income Ratio How To Improve Yours Upgrade

Ex 99 1

What Is Debt To Income Ratio Let S Break It Down Mortgage Firsttimehomebuyer Homeowner By Beth Tucker The Mortgage Company Nmls 1159576 Facebook